The language of statutory notices in the UK is set to become less threatening and more supportive. Letters which are used to chase consumers for debts have been described as ‘thuggish’ by experts and the change to the outdated rules are being universally welcomed.

The Money and Mental Health Policy Institute have championed the cause, pushing to highlight the negative effects that these letters can have on those who are facing mounting issues with debt.

Set up by Martin Lewis, the charity has successfully highlighted the catastrophic effects that these notices can elicit and forced the government’s hand to overhaul current legislation.

Lewis has said that the proposed changes could well help to save the lives of those struggling with money issues. He went on to say:

“It’s no exaggeration to say that this change could save lives.

Over 100,000 in England attempt to take their lives each year due to debts, and four times that consider it.

So we’re delighted the Government has agreed to back this element of our campaign and change the default demand rules.

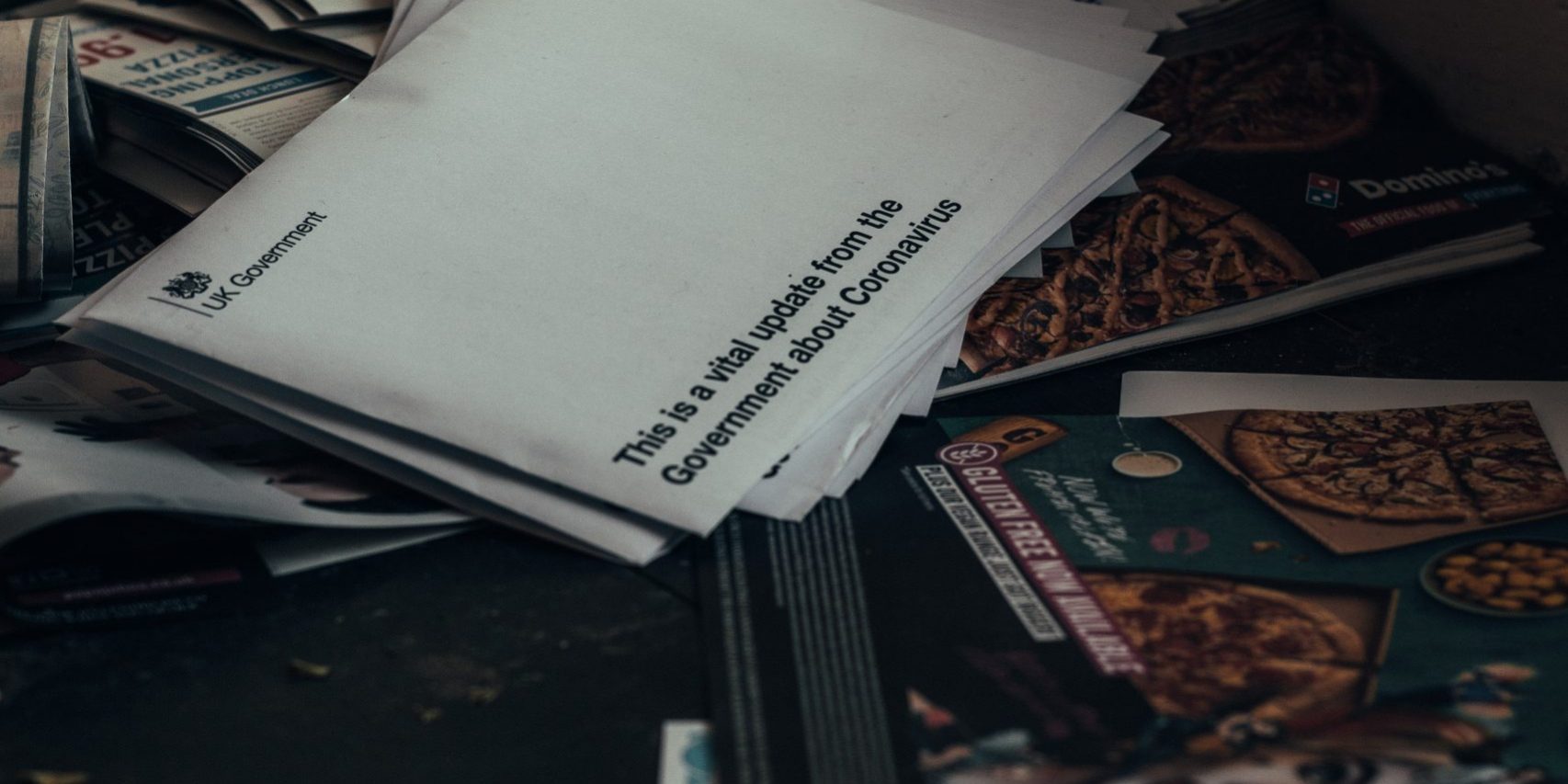

The last thing people struggling with debt need is a bunch of thuggish letters dropping through the letterbox, in language they can’t understand, written in shouty capitals alongside threats of court action.

And the timing is crucial, with millions of people facing debt and distress due to the pandemic, the sooner we end these out-of-date laws which force lenders to send intimidating letters the better.

Today’s changes will make the most distressing debt letters much less intimidating, and crucially will also easily and calmly point people in serious debt to get the free, non-profit, debt advice they need.”

The new rules surrounding statutory notices are set to come into effect sooner rather than later, slated for December of this year. This is the first time that the law has been changed at all in 40 years in regards to default notices. Changes include:

- Language and presentation of key info will be simplified.

- Legal jargon to be minimised.

- Jargon to be replaced with more universally-understood wording.

- Advice on where to seek debt advice for free.

- No capital letters.

- Capitals to be replaced by bold or underlined text.

Lenders that will be affected by these changes are those who are regulated by consumer credit agreements. This includes personal loans, overdrafts, credit cards and motor finance contracts. All lenders falling under this category will be required by law to make the changes within six months.

Eric Leenders who is managing director for personal finance at UK Finance said:

“The banking and finance industry understands the impact that debt can have on a customer’s wellbeing and has been working closely with Government to help support customers, especially those in vulnerable circumstances.

Lenders have to send default notices and these important changes announced today will ensure that customers receive more appropriate and supportive communications.”

Economic Secretary to the Treasury, John Glen, echoed these sentiments:

“As part of our effort to help to people struggling with their finances, it’s right that we look again at the legislation around these letters.

Some vital work has been done by charities, the industry and the Money and Mental Health Policy Institute and I am grateful for their support in tackling this important issue.”